We all know that tax is inevitable for international sales, and that same is in Magento 2. So, today we are back with the very popular topic that how to add value added tax (VAT) in Magento 2. However, Magento serves its service worldwide. So, it does allow store owners to count the tax as per their country's rules. Moreover, value-added tax(VAT) is a great Magento 2 backend solution for store owners. Let's take a deep dive into it.

Magento is the best eCommerce platform that we all know right? But it is also important to choose the right hosting server for your Magento store. Upgrade your hosting server to nexcess or hostinger. They are the most popular ones and provide the best service above all.

What is Value-added Tax(VAT)?

Value-added Tax means charges some tax on goods and services. The rate measurement can be different as per the county's rules. Moreover, the VAT rates are different as it depends on what type of goods or services you offer like products, materials, or services. Additionally, it is also based on the stage you as a merchant is at in the manufacture or distributer.

Sometimes, you need to calculate more than one VAT rate rely on your store. When you add VAT in your store, it will be easy to create a database that stores all the details like current VAT rates, your country, customer type, and many more.

How to add value-added tax (VAT) in Magento 2

Value-added tax(VAT) is calculated based upon the percentage of product price. You can use the extension to calculate VAT or else configure the default VAT in your Magento 2 store. There are many ready-made Magento 2 VAT extensions. One of them is Milople's Magento 2 VAT Exempt extension is also ideal for your store. Let's check outstep-by-step how to add value added tax (VAT) in Magento 2

Step 1: Log in to your admin panel.

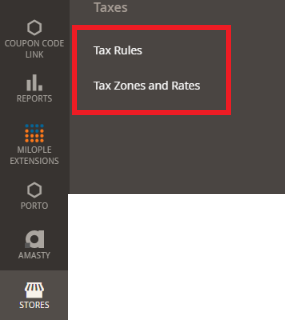

Step 2: Go to Stores > Taxes > Tax Rules.

Note: If you don't have any Customer Tax Classes then compose the Customer Tax Classes first.

Step 3: Click on the Add New Tax Rules.

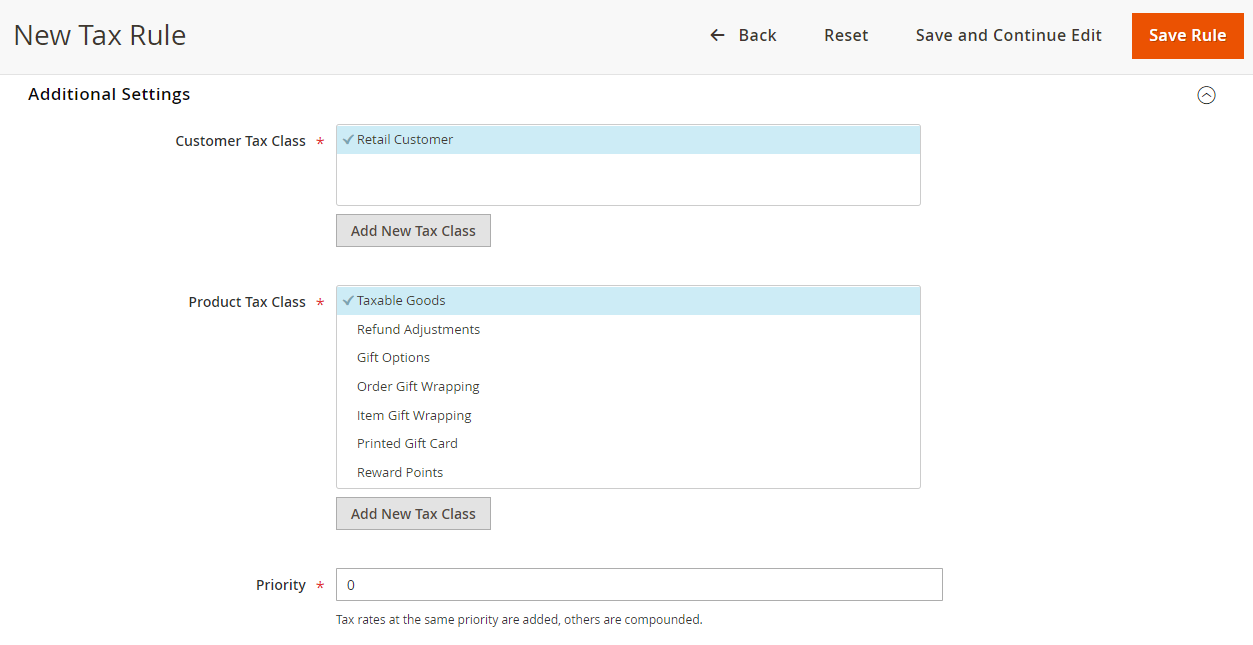

Step 4: Expand the Additional Settings.

Step 5: Here, click on the Add New Tax Class under the Product Tax Class section.

Create and add the following three classes.

- VAT Standard.

- VAT Reduced.

- VAT Zero.

Click on Save Rule. Check out the below Screenshot.

Step 6: Now, go to the Tax Zones and Rates.

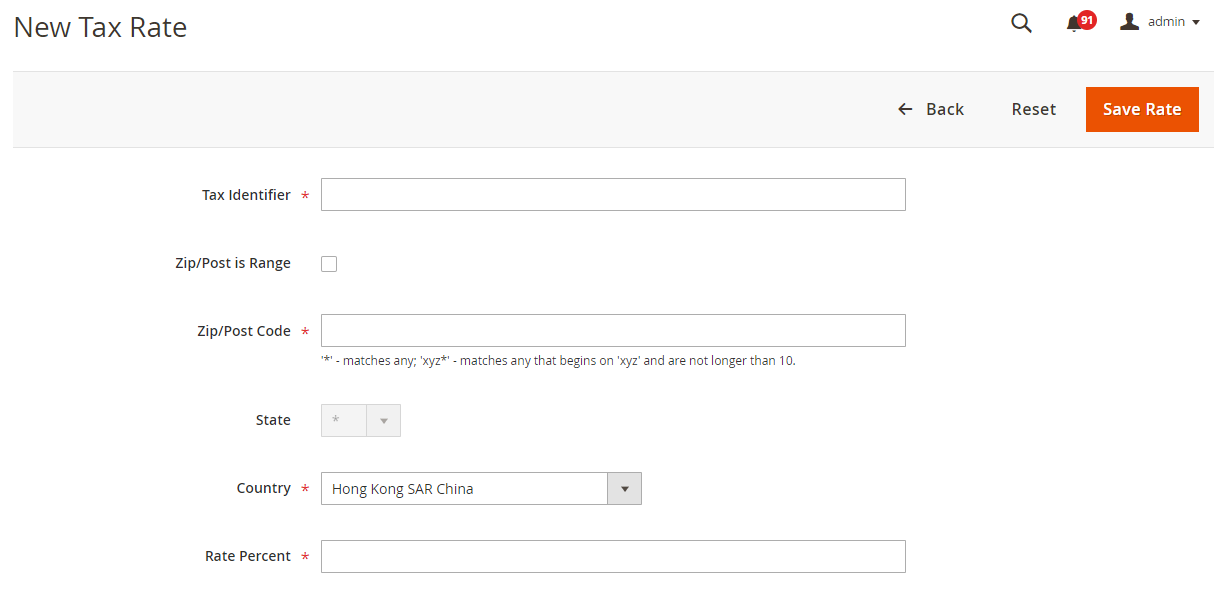

Step 7: Then, click on the Add New Tax Rate. Here, you need to fill in all the required fields.

Step 8: To save changes, click on the Save Rate.

Step 9: Then, go to Stores > Taxes > Tax Rules.

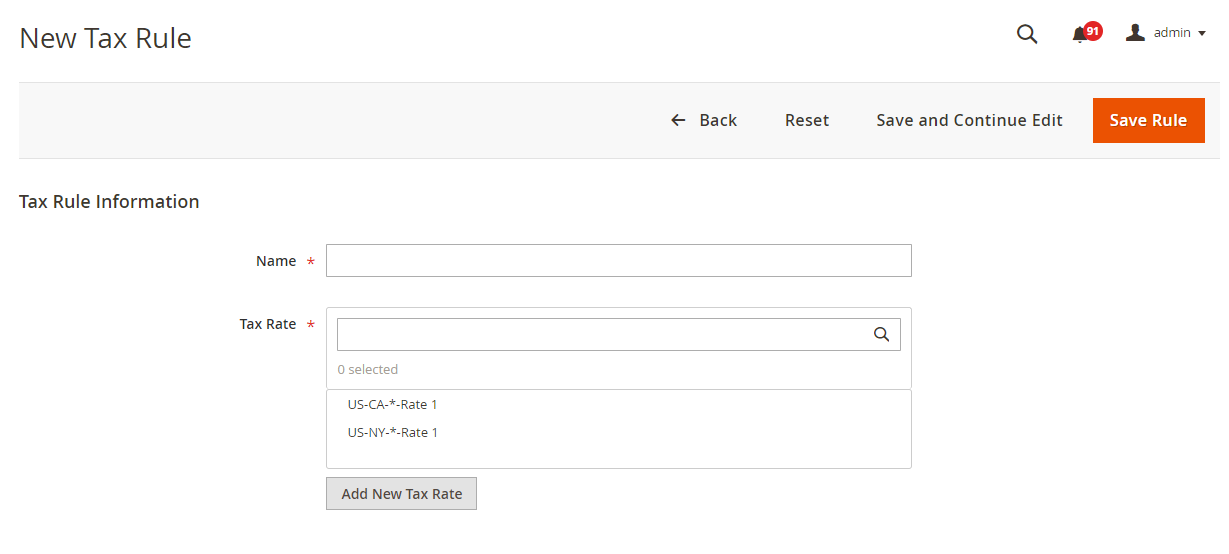

Step 10: Click on Add New Tax Rule. Fill in all the required fields.

Step 11: To save everything, click on the Save Rule.

Step 12: Now, add tax class to the product.

Step 13: Go to Catalog > Products. Select the product and click the option Edit.

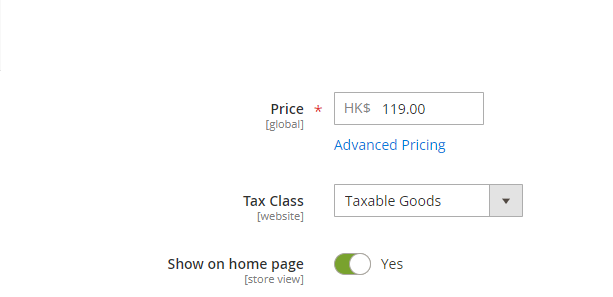

Step 14: Select the relevant Tax Class from the dropdown.

Step 15: Click on the Save button to save all changes.

Quick Links:

- How to create a payment method in Magento 2.

- Magento 2 is currently unable to handle this request. Fix Magento 2 error 500.

Conclusion: How to add value added tax VAT in Magento 2

In the end, I hope you got sufficient knowledge about how to add value added tax (VAT) in Magento 2. Additionally, it will help you to add more than one VAT rate and calculate the tax. Moreover, you can integrate Milople's VAT-exempt plugin. It manages such situations as medical or any emergencies VAT relief. You can easily create and manage a purpose for customers to checkout with zero VAT. Apply the VAT speedily to your Magento store.

Update your customers about your business through email. When you start sending email campaigns, it is necessary to choose the right platform for that. Sendinblue and GetResponse can be the best choice.

Validate your login

Sign In

Create New Account